Originally published on May 10, 2024 on Grainews

By Art Lange

As we embark on a new production year, there are several new challenges. A recent Canadian Federation of Agriculture (CFA) report says “the cost of critical farm inputs such as fuel, fertilizer, feed, machinery, pesticides, land and labour has increased dramatically.

“When coupled with high inflation, interest rates and a price on carbon for essential farming activities for which farmers have no viable alternatives, Canadian producers are facing tremendous pressure on their farm financials and mental health.”

In addition to increasing input costs, commodity prices for grains and oilseeds have dropped over the last couple of years. Below you’ll see two graphs showing Alberta cash prices for hard red spring (HRS) wheat and canola over the last five years. The data are from the statistics section at Alberta Agriculture and Irrigation.

So, we have a double whammy facing the grains sector: rising costs and falling commodity prices. This means grain farmers must be very astute business managers in 2024, since the implications for their financial and mental well-being are huge. One factor is that careful management of cash flows is required to have money available to pay for inputs, debt servicing and living expenses at the required times during the year. This is especially important in the face of rising costs and decreasing returns, as well as increased debt servicing costs resulting from higher interest rates. I wrote an article about that in the April 2, 2024 edition of Grainews.

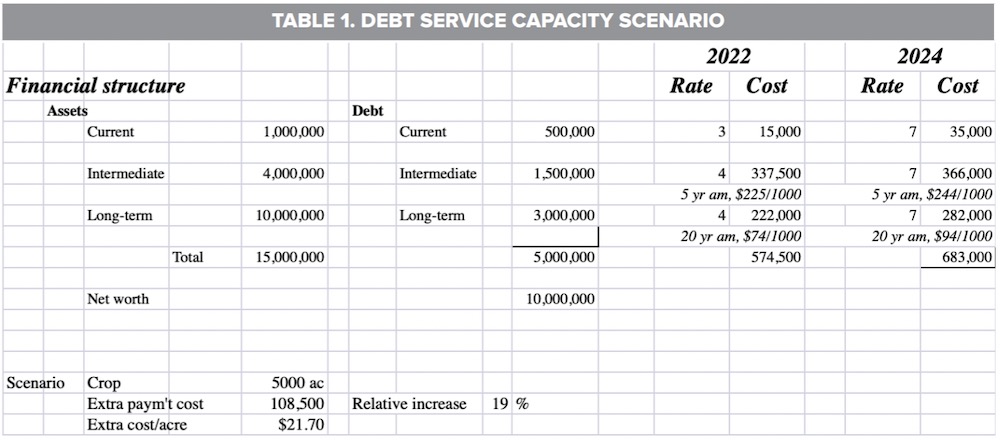

To illustrate the situation for 2024, I’ve attached a scenario for a hypothetical 5,000-acre farm (see Tables 1 and 2 below). Following the present reduced market prices, I have dropped the expected 2024 gross income to $500 per acre, from $686 in 2022. The only other changes were the interest rates on the loans. Variable costs are assumed to be similar to what they were in 2022. For 2022 the interest rates used are as follows: three per cent on the current debt, and four per cent for the intermediate and long-term debt. For 2024, the interest rates used are seven per cent for all the debt — current, intermediate and long-term.

The bottom line shows that the 2022 scenario had an estimated $455,500 surplus and the 2024 scenario has a $483,000 deficit. So that could be quite a shock to your finances this year and maybe next.

Here are some qualifying factors — and some steps you could take to alleviate this financial dilemma:

- If you have an operating farm, it’s unlikely all your loans will come up for renewal this year, so you won’t be facing a seven per cent interest rate for all your loans. You will likely be somewhere between the two scenarios. If you are on annual payments, the real crunch will come at this time next year, when loan payments at the higher interest rate start.

- The federal government has announced the interest-free portion of the cash advance program for 2024 is now up to $250,000 which may be available if you qualify under certain conditions. Also, farmers may be eligible for cash advances for another $750,000 (on top of the $250,000 interest-free portion) at preferred rates, which will likely be considerably less than seven per cent.

- Some suppliers are offering loans for crop inputs at preferential rates till February 2025. This could also help reduce your current interest charges.

- Depending on your financial situation and credit rating, you may be able to negotiate a better interest rate than those posted by the lenders. Usually, their first offer is not their best offer.

I have done several projections for farmers for 2024 at the present high interest rates for new purchases and in all cases the farmers have decided to not make those new purchases. So, I really want to caution new or expanding farmers to carefully do projections before they enter into new purchases. Do detailed projections for your existing debt servicing ability — with the current input costs and lower commodity prices — and then add your anticipated new purchase on top of that. Are you still in a comfortable place financially? If not, please delay your new purchase until interest rates come down.

I use a farm financial spreadsheet called the Agricultural Business Analyzer (ABA) that does all the calculations mentioned above and many more. It is a really good tool to use to analyze your present situation and new purchases before you buy. ABA is a free download from the Farm Management Canada website.

If you would like some help with doing financial projections, please contact me.